News and Events

Learn about how we are permanently protecting agricultural, wildlife, and recreational lands for our community.

Ways To Give

-

• Keep ownership of your land

• Receive potential tax benefits

• Protect land for future generations

• Maintain agricultural use

-

• Support local conservation efforts

• Learn about land protection

• Make a difference in your community

• Preserve Colorado's natural character

FAQs

-

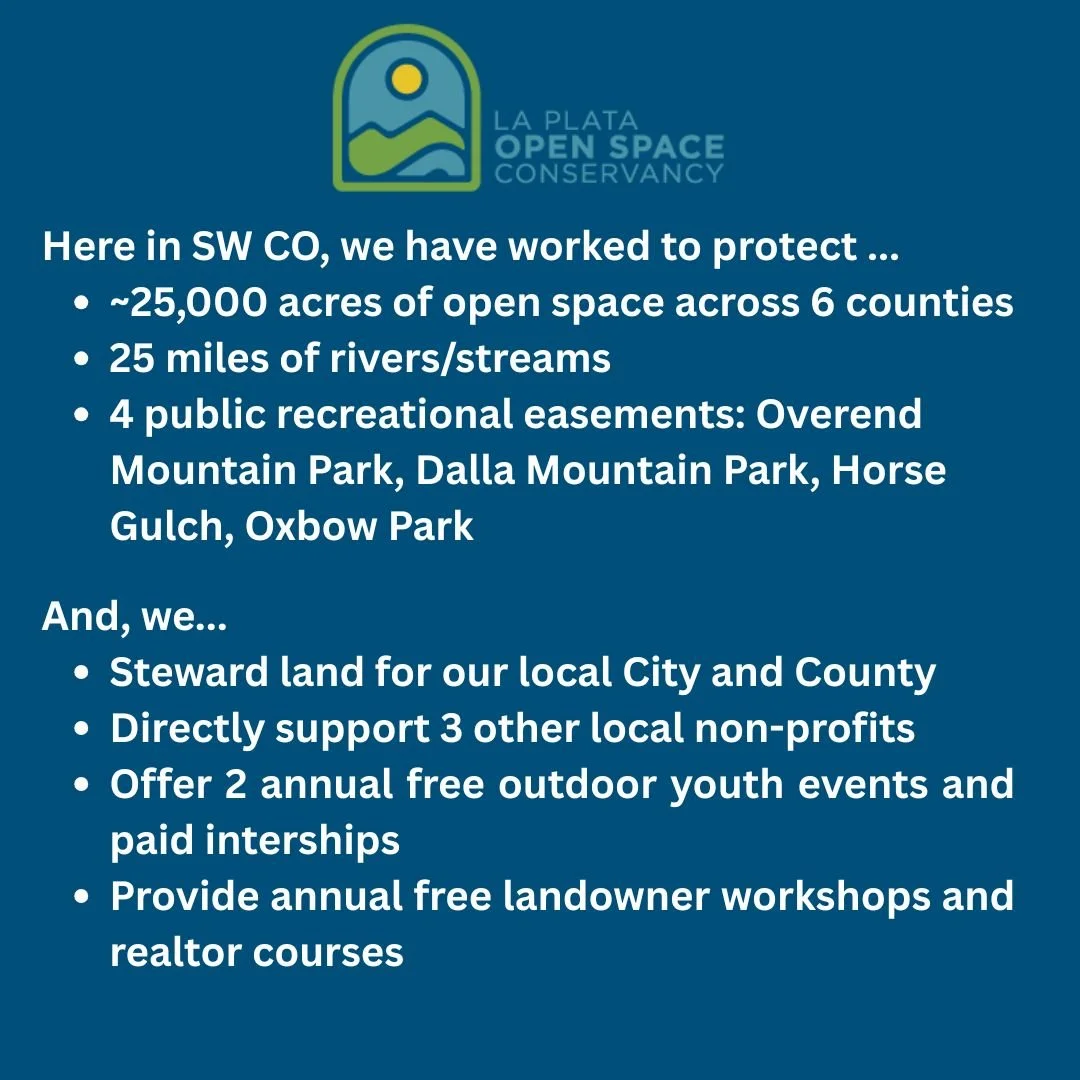

A conservancy or land trust is a private, nonprofit 501(c)3 organization that serves its community by conserving land that is of significant value to its community.

We work with landowners, donors, and community partners to permanently protect agricultural lands, wildlife habitats, open spaces, and historically significant properties throughout La Plata County, Colorado.

-

Colorado Conservation Tax Credits are available to donors of qualified conservation easements. Colorado taxpayers who donate such qualified easements may claim a state tax credit, based on the fair market value of the conservation easement.

Current tax credit value: 90% of fair market value

Maximum credit: $1.5 million total

Carry forward period: 20 years

Credits can be transferred one time to other Colorado taxpayers

Additionally, donating a conservation easement qualifies under the Internal Revenue Code as a public charity, which can entitle donors to significant federal tax savings.

-

Landowners who love their land choose to donate a conservation easement in order to permanently protect their land from inappropriate development while continuing to own the property.

Each conservation easement is developed specific to a landowner's needs and wishes, and is legally written to accommodate those needs while best protecting the resources of the land.

Your conservation donation helps:

Preserve Colorado's natural heritage for future generations

Protect working farms and ranches

Maintain wildlife corridors and habitats

Support outdoor recreation and community access